N26 Savings Account

Designing for growth: the N26 Savings account case

Problem statement

People who aim to build a secure financial safety net or generate additional income face challenges in finding reliable and accessible ways to earn interest or returns on their savings, which can limit their ability to achieve financial stability and make the most of their surplus funds.

In this case, you will see how we created a highly valuable product for both the company and customers, which drove both customers and revenue growth.

Goals

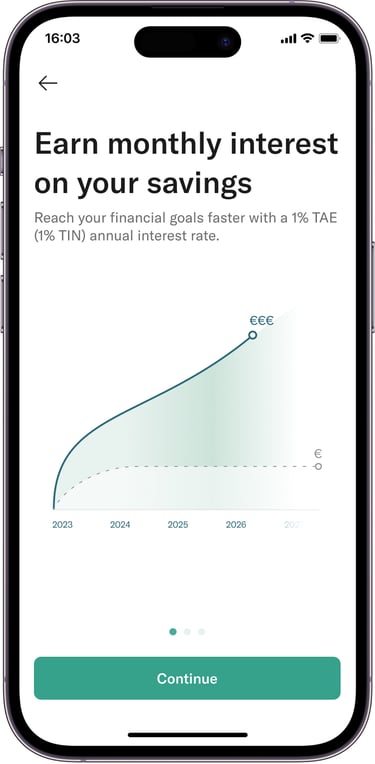

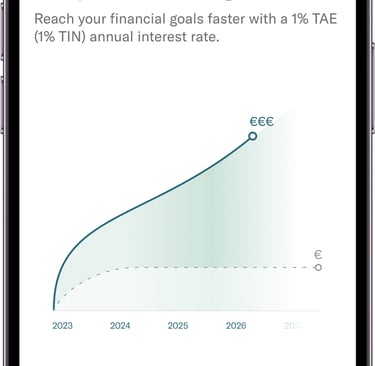

1. Enable customers to earn interests on their savings

2. Increase account deposits in the company

3. Increase customer base (MAU)

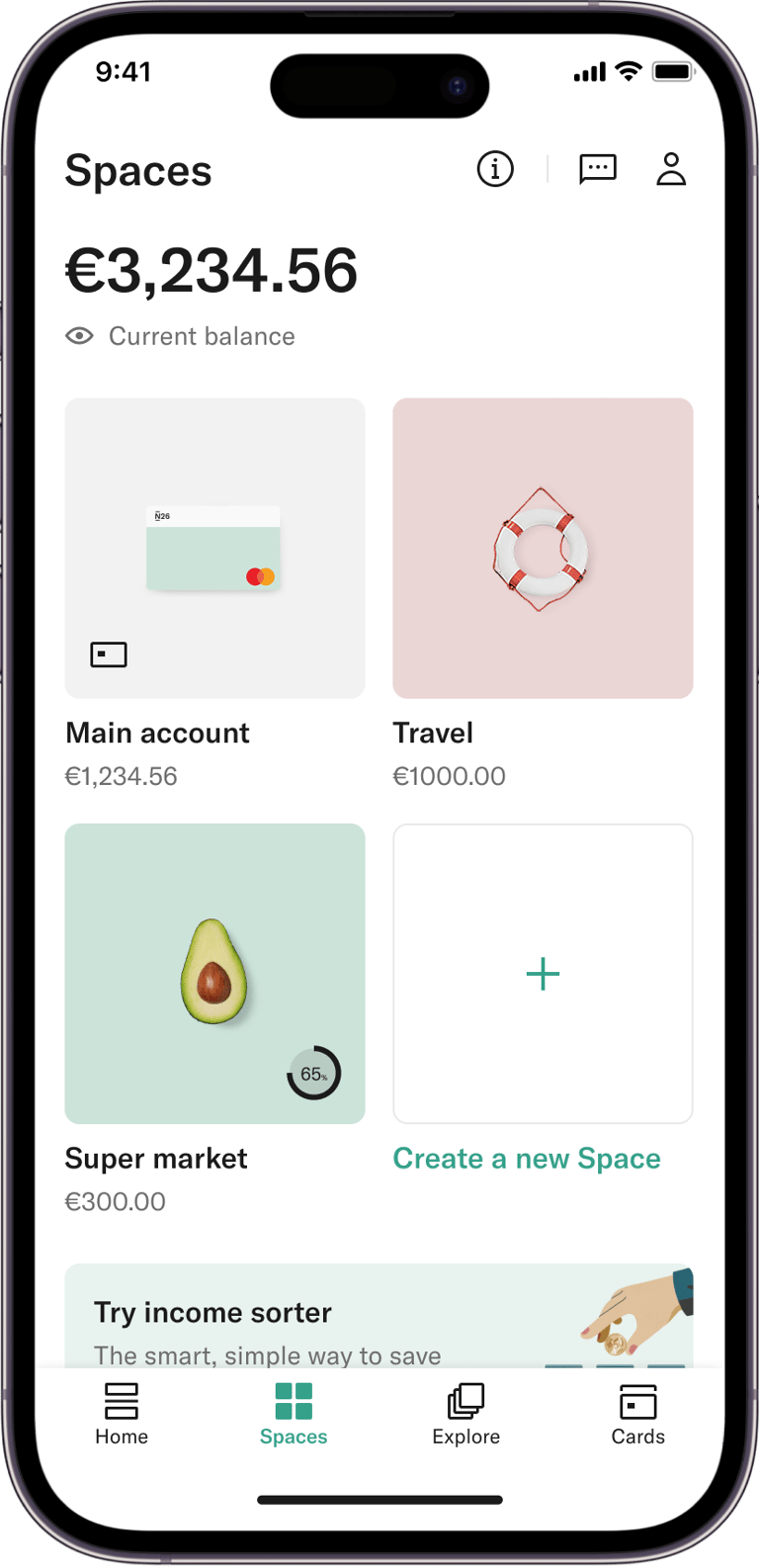

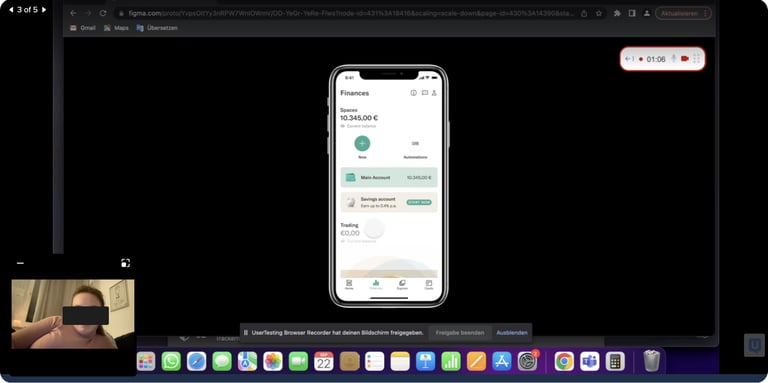

'Spaces' home screen

Summary

Context

'Spaces' has always been one of N26’s most popular products due to the convenience of allowing customers to separate and organize their money into different 'spaces'. In addition, 57% of MAUs also used 'Spaces' to save. However, customers would like to see their money grow over time, which wasn't possible.

That’s why we saw an opportunity to offer a Savings Account to our customers.

Is there a need for Savings?

Disscovery

Research

Extensive research was conducted to understand the market fit, customer needs and opportunities. I will share here the main questions we wanted to answer in order to help us gain more clarity on the scenario:

Is there any demand from our customers to save?

Are they saving right now? How?

How much do they save?

Customer comments, survey & data analysis

In order to find the answers for these questions, we had to dig into some data from customer comments, survey and internal data dashboards. The findings are the following:

1. Most requested feature

Customer comment analysis showed that Savings was the most requested feature, even above credit or loan products.

Many users explicitly said that the lack of a savings option with interest was the main reason they did not move all their funds to N26.

2. Yes, they save

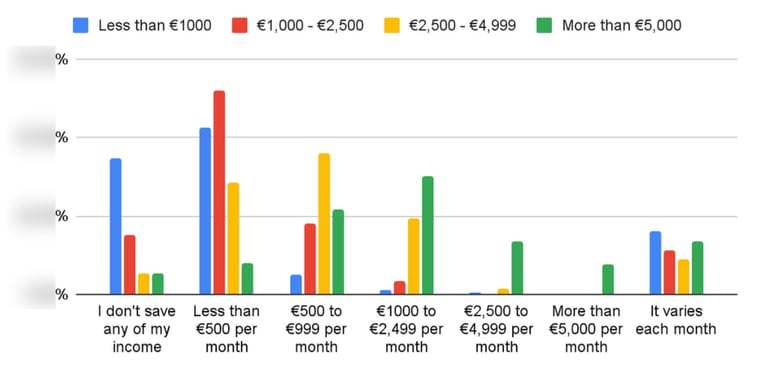

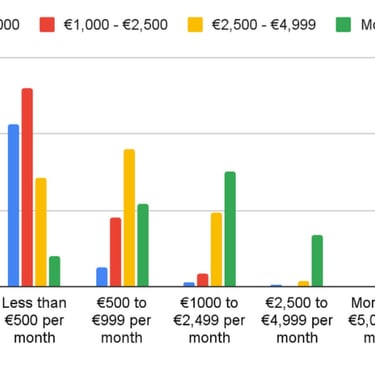

Around XX% of N26 customers already save part of their income every month, but they do it using Spaces, which does not generate interest.

Users save not only for short-term goals but also to prepare for their future or for emergencies.

3. There's money on the table

"YY%" of our customers are saving between 500€ and 2.500€ per month using their 'Spaces'.

These insights confirmed both customer demand and financial potential for a dedicated savings product.

Survey - How much do people save?

"I’m saving for my future or unexpected emergencies and I’d like to earn interest."

- Customer comment from user interview.

Usability testing to check 'findability', comprehension and usage

Validation

Moderated user testing sessions

Moderated usability testing

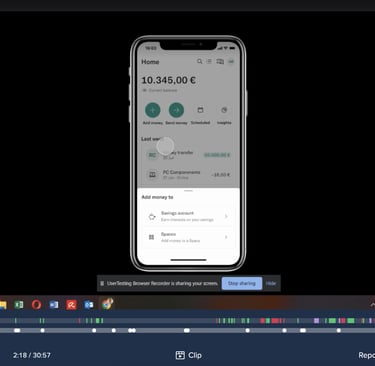

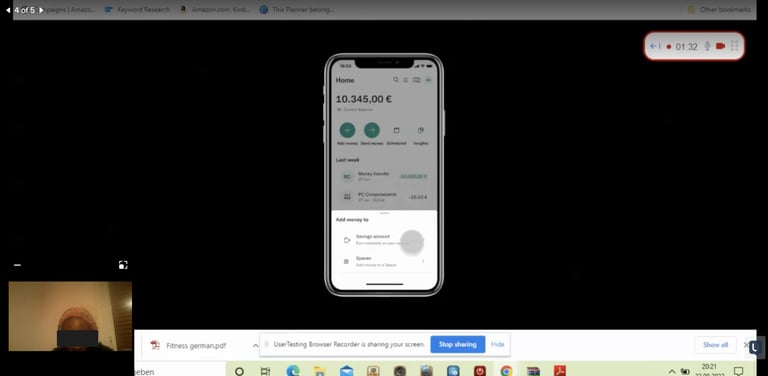

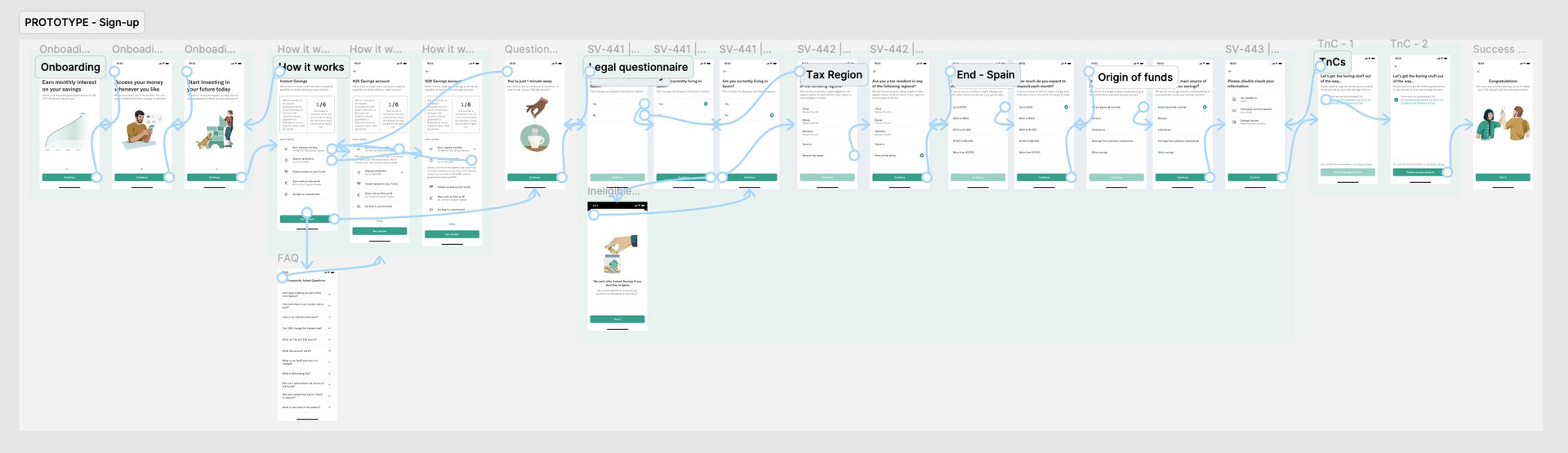

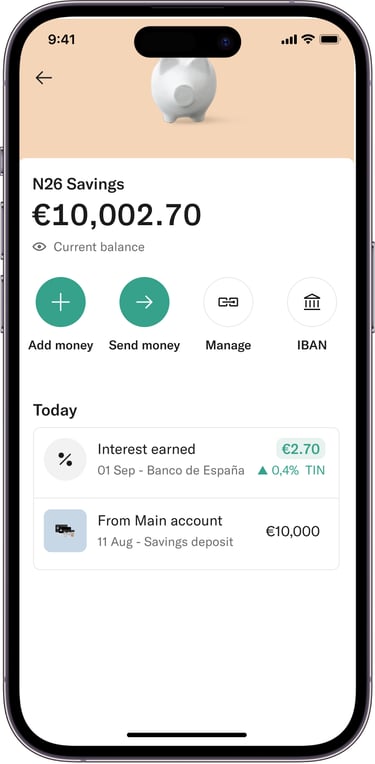

Based on previous research insights, I designed a high-fidelity prototype of the new Savings Account with interest, fully integrated into the existing N26 app experience.

The main goal was to evaluate how real users discover, understand, and interact with the new product compared to Spaces, which was already familiar to them.

Goal

The goal was to evaluate the experience aspect on how users find, understand, and interact with the new product compared to 'Spaces.'

Findability — Do users intuitively know where to look for the new Savings product inside the app?

Comprehension — Do they understand the difference between Spaces (short-term, no interest) and Savings (long-term, with interest)?

Ease of use — Can users easily open, fund, and withdraw from their savings account?

Tasks

Participants were given two situations to complete using the prototype:

Scenario 1: Receive an inheritance of €10,000 and decide the best way to save it. Create and fund a savings account within the N26 app.

Scenario 2: Due to an unexpected expense, withdraw €200 from the savings account back to the main account.

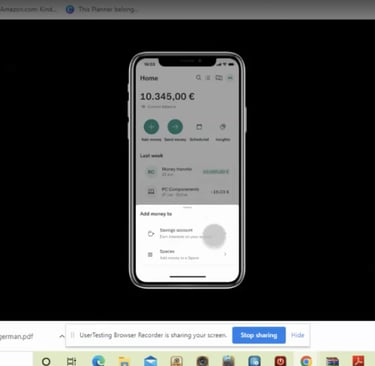

The first version that was tested and went live

Solution

Savings account with interest sign-up flow

The prototype represented a MVP approach to validate the concept quickly while minimizing design and engineering effort. Instead of redesigning core flows, the new Savings Account was layered into the existing Spaces architecture, preserving consistency and enabling faster testing.

Entry point, sign-up and home of N26 Savings account

Sign-up prototype

What did we achieve after this research and experiment?

Results

Goals x Results

1. Enable customers to earn interests on their savings

- The product itself was a solution to allow customers to grow their money through savings account deposits.

2. Increase account deposits in the company

- After the rollout, "XXX" savings accounts were created bringing €€€ in deposits.

3. Increase customer base (MAU)

- The MAU increased from 36% to 74%